Introducing GeoInvoice Upstream Sales Tax Matrix

Old upstream sales tax paradigm: paper, spreadsheets, network folders, revenue websites, time consuming, steep learning curve, software bloat

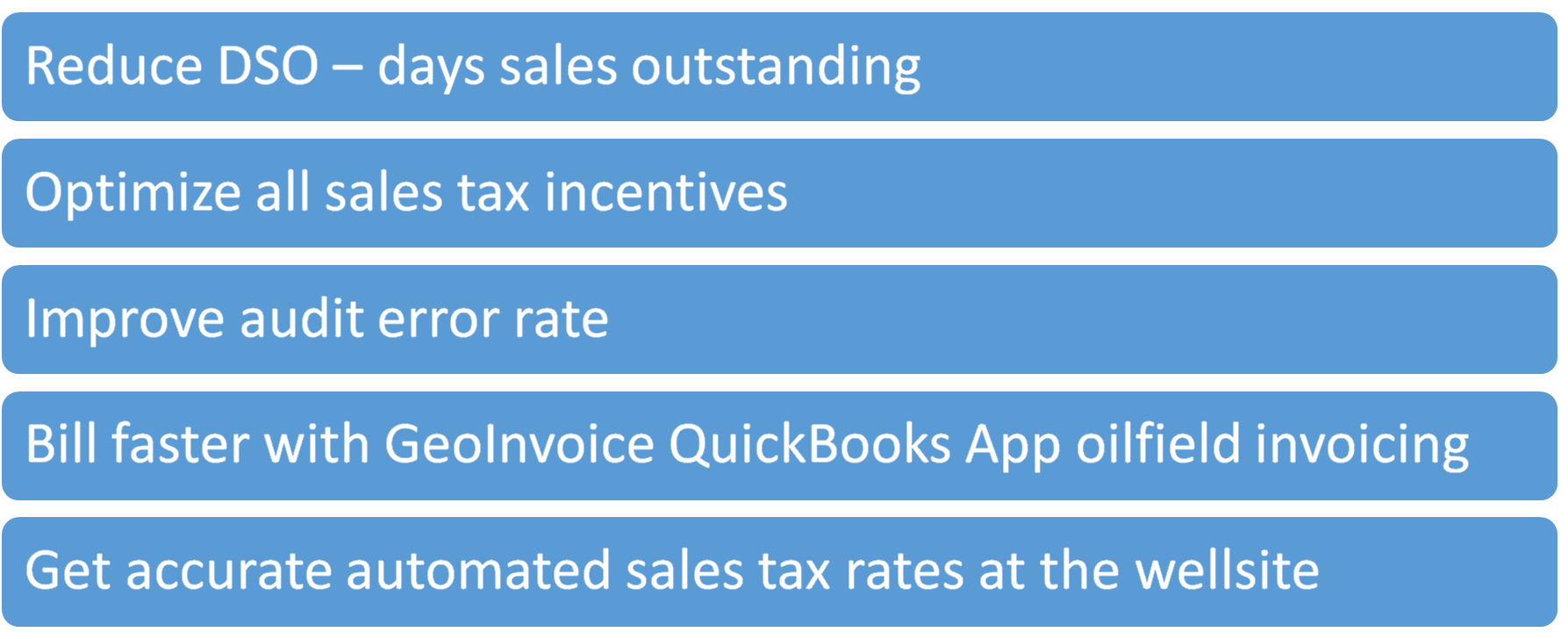

Innovative cloud based upstream sales tax solution: custom built for the upstream service provider and operator. Software that connects the field to the office, centralized sales tax rules and rates, digital paperwork

- Create Field Ticket – Create a job with GeoInvoice Field Service mobile app & send to office

- Validate Sales – What is validation? Validate invoice attributes, service type, drilling phases & situs selection

- Create Invoice – GeoInvoice oil and gas invoicing rules include readable service type, drilling phase type, separated contracts & sourcing rules, accurate sales tax calculation

- Send Invoice – GeoInvoice oil & gas invoicing attributes include geolocation of wellsite, well name, AFE, customer cost center

- Sales tax reports – GeoInvoice sales tax reports are customized for each state’s sales tax filing requirements. Includes Texas Well Service Tax, New Mexico Gross Receipts deductions

GeoInvoice is the intelligent automated sales tax solution built solely for the upstream segment of the oil and gas industry.

For more information, visit our us at:

To speak to Susette, CPA and start your sales tax planning for 2023 Get in Touch »

Susette is the founder of GeoInvoice which provides sales tax solutions for the mobile workforce. Susette patented location-based sales tax calculation for sales to locations that do not have an address. U.S. Patent No. 9,589,259 B2.

Location-based sales tax calculation was derived from Susette’s experience in managing upstream oil and gas sales tax compliance.

She has worked to deliver sales tax content and services to help the upstream OFS segment get sales tax rights. Susette’s sales tax knowledge comes from her tax professional roles in the oil and gas industry.

Susette received a BBA in Finance, Magna Cum Laude from Sam Houston State University. She is a certified public accountant and certified global management accountant. Member of the AICPA, Texas Society Of CPAs, Petroleum Accountant Society of Houston